sacramento property tax rate 2021

2021-22 Sacramento County Property Assessment Roll Tops 199 Billion. For more information view the Parcel Viewer page.

Property Tax California H R Block

Did South Dakota v.

. The deadline for paying the second installment of your 2020-2021 Sacramento County property taxes is coming up very soon. Citizens pay roughly 291 of their yearly income on property tax in Sacramento County. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Property information and maps are available for review using the Parcel Viewer Application. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. 7 2021 please contact the Sacramento County Ta x Collectors Unsecured Property Tax Unit at 916 874-7833 between the hours of 9 am.

This is the total of state county and city sales tax rates. Exemptions are available in Sacramento County. Late payments will incur a 10 percent penalty plus a 2000 cost for each tax bill.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year. 1 2021 and do not receive a tax bill by Aug.

Sacramento Property Tax Rates. 2021-22 1036 104 101036 1 Increase to base year value is limited to 2 percent pursuant to California Constitution article XIII A section 2b. The December 2020 total local sales tax rate was also 8750.

2021 March 17 2022. Payments are due no later than April 12 2021. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. 2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171. The Sacramento sales tax rate is 1.

2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. Ultimate Sacramento Real Property Tax Guide for 2021. Transfer tax can be assessed as a percentage of the propertys final sale price or simply a flat fee.

When calling the Tax Collectors Office your call is answered by our automated information system. The 2018 United States Supreme Court decision in South Dakota v. Business Property Tax In California What You Need To Know 3636 American River Drive Suite 200 M ap.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. Tuesday September 21 2021. These tax bills are mailed only once a year however property owners may pay their bills in two installment payments.

The assessment roll is the total gross assessed value of locally assessed real business and personal property in Sacramento County. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties.

Average Property Tax Rate in Sacramento. Sacramento Property Tax Rate 2021. The minimum combined 2022 sales tax rate for Sacramento California is.

View the E-Prop-Tax page for more information. Browse Current and Historical Documents Including County Property Assessments Taxes. The California state sales tax rate is currently 6.

In November 2020 California voters passed Proposition 19 which modifies Article XIIIA aka. Available 24 Hours a day 7 days a week 916 874-6622. If you owned unsecured property in Sacramento County such as a boat or aircraft or if you leased or owned fixtures and equipment related to a business on Jan.

The median home value in Fresno County is 237500. Tax Collection and Licensing. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021.

3636 American River Drive Suite 200 M ap. The County sales tax rate is. Sacramento County will mail about 471594 secured property tax bills which are payable beginning Nov.

Property information and maps are available for review using the Parcel Viewer Application. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee. That means that while property tax rates in Fresno County are similar to those in the rest of the state property taxes paid.

Information in all areas for Property Taxes. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143.

Here is the most recent publication from the California State Board of Equalization BOE dated April 1 2022. The California sales tax rate is currently. The Sacramento sales tax rate is.

The property tax rate in the county is 078. Ad Research Is the First Step to Lowering Your Property Taxes. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

All are public governing bodies managed by elected or appointed officers. Payment must be received in the Tax Collectors Office. This is the total of state and county sales tax rates.

For more information view the Parcel Viewer page. The Sacramento County sales tax rate is 025. The property tax rate in the county is 078.

The minimum combined 2022 sales tax rate for Sacramento County California is 775. With our guide you will learn important knowledge about Sacramento property taxes and get a better understanding of things to anticipate when you have to pay the bill. Tax Rate Areas Sacramento County 2021.

Enter Your Address to Begin. The first installment payment is due on Nov. Proposition 19 Brings Significant Changes to Property Tax Rules for Inter-County and Inheritance Transfers.

Automated Secured Property Information Telephone Line. Partial payments are not accepted. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 22 05 galt city of 24 06 citrus heights city of 27.

BOE Proposition 19 Fact Sheet.

Cryptocurrency Taxes What To Know For 2021 Money

Sacramento County Ca Property Tax Search And Records Propertyshark

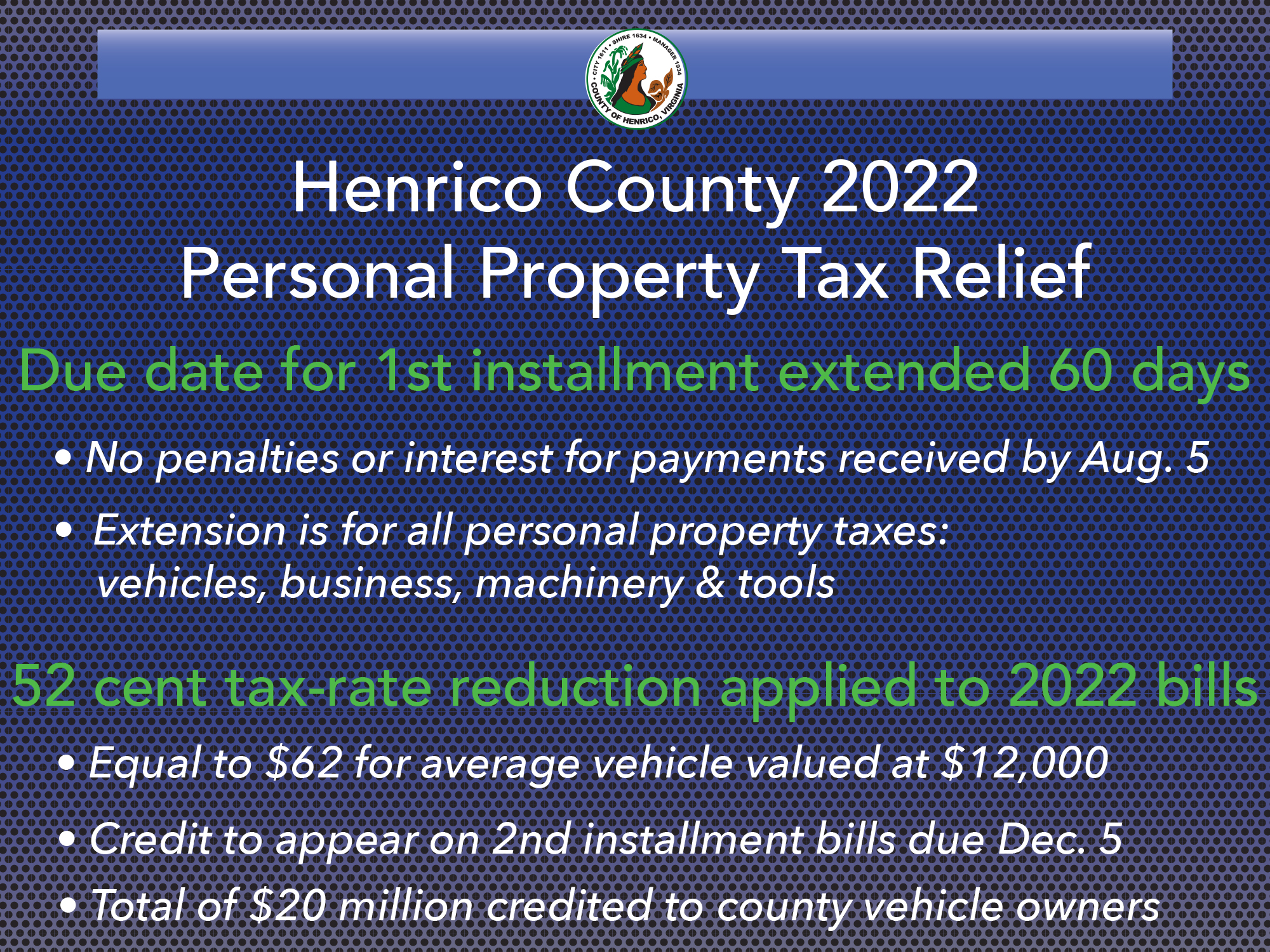

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Why Now Is The Best Time To Refinance Your Home Real Estate Tips Real Estate Advice Mortgage Tips

Secured Property Taxes Treasurer Tax Collector

Sacramento County Ca Property Tax Search And Records Propertyshark

2022 California Property Tax Rules To Know

Pin On 5 The Philadelphia Editor 2018 Edition

Riverside County Ca Property Tax Calculator Smartasset

Davlyn Investments Acquires Terraces At Highland Reserve Apartment Complex Near Sacramento For 95m Rebusi Sacramento Apartments Terrace Roseville California

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Davlyn Investments Acquires Terraces At Highland Reserve Apartment Complex Near Sacramento For 95m Rebusi Sacramento Apartments Terrace Roseville California

Moving To Washington Local Move California Real Estate Moving Long Distance

Secured Property Taxes Treasurer Tax Collector